Rebuilding Your Credit?

How can you rebuild your credit after life's derogatory events.

Rebuilding credit can be a daunting task, especially after experiencing a financial setback such as foreclosure or bankruptcy. However, it is not an impossible feat. With patience, discipline, and a strategic approach, you can gradually rebuild your credit score and regain financial stability.

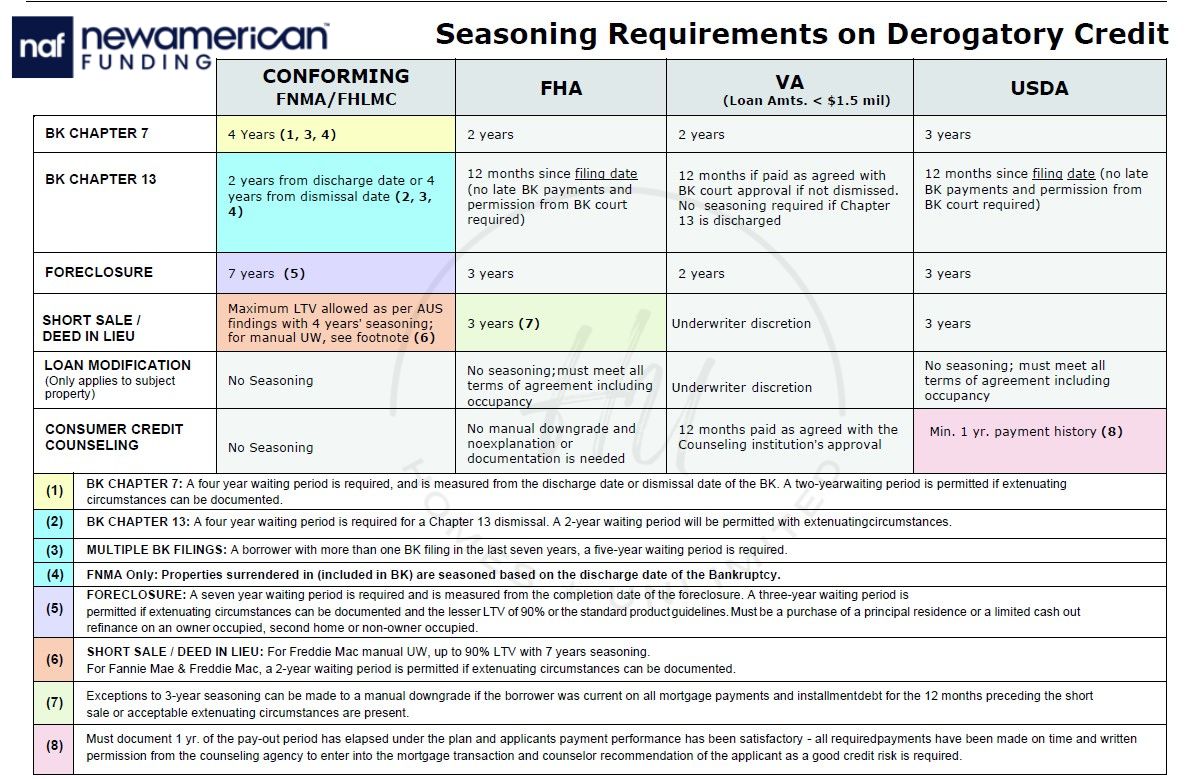

One crucial aspect to understand is the waiting period after a derogatory event, such as foreclosure or bankruptcy. These events can significantly impact your credit score and make it challenging to obtain credit in the future. However, it's essential to remember that there is light at the end of the tunnel, as these negative marks do not remain on your credit report forever.

Foreclosure, for instance, remains on your credit report for seven years. During this time, it may be difficult to secure new credit or obtain favorable loan terms. However, as time passes, the impact lessens, and with responsible financial behavior, you can gradually rebuild your creditworthiness. It's crucial to focus on demonstrating your ability to handle credit responsibly during this waiting period.

Similarly, bankruptcy has a significant impact on your credit score and can remain on your credit report for seven to ten years, depending on the type of bankruptcy filed. However, this waiting period doesn't mean that you cannot rebuild your credit during this time. By utilizing secured credit cards or becoming an authorized user on someone else's credit card, you can begin to establish positive credit history. Additionally, making timely payments on other bills, such as rent or utilities, can also help improve your creditworthiness.

Credit cards can play a vital role in rebuilding credit if used responsibly. However, it's essential to be cautious and avoid falling back into old habits. One effective strategy is to obtain a secured credit card, which requires a cash deposit that serves as your credit limit. By making small purchases and paying the balance in full each month, you can showcase responsible credit usage. Over time, this can help improve your credit score and build trust with lenders.

Remember, rebuilding credit takes time, and there are no quick fixes. It's essential to be patient and consistent in your efforts. While waiting for derogatory events to be removed from your credit report, focus on practicing good financial habits and making responsible decisions. Paying bills on time, keeping credit card balances low, and avoiding new debt can all contribute to a positive credit history.

In conclusion, rebuilding credit after experiencing derogatory events like foreclosure or bankruptcy requires patience and diligence. Understanding the waiting period associated with these events is crucial. By demonstrating responsible financial behavior and using credit wisely, you can gradually rebuild your creditworthiness and pave the way to a brighter financial future.

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

dgonzalez@homesunlimited.solutions

8803 Futures Drive Unit 10A, Orlando, Florida, 32819, USA