Maximizing Tax Savings When Selling Your Home

When it comes to real estate, understanding capital gains tax is crucial for both sellers and investors. This tax can significantly impact your profit margins, so knowing how to navigate it effectively is essential. In this blog, we'll explore some common questions about capital gains in real estate, discuss strategies for minimizing or avoiding these taxes, and touch on recent news that may affect your investments.

What are Capital Gains Taxes?

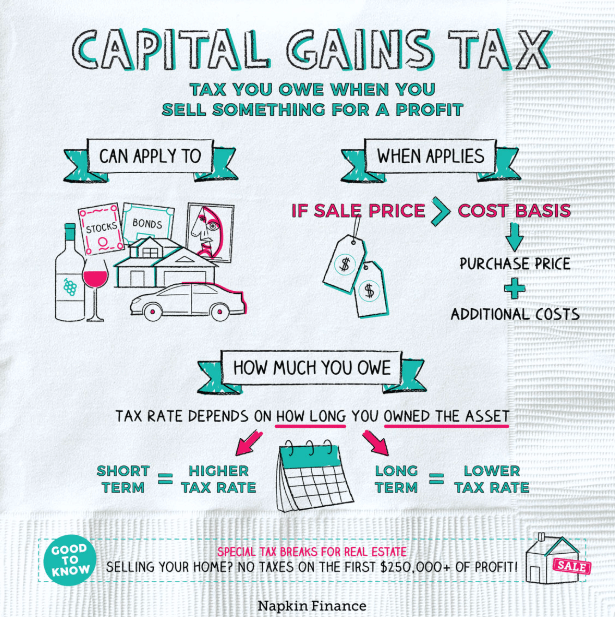

Capital gains taxes are levied on the profit you make from selling an asset like real estate. The tax rate depends on how long you've held the property—short-term (less than a year) or long-term (more than a year). Short-term capital gains are taxed at your ordinary income tax rate, while long-term capital gains enjoy lower rates.

How Can Sellers Avoid Capital Gains Tax?

For sellers, one of the most effective ways to avoid capital gains tax is through the primary residence exclusion. If you've lived in the home for at least two out of the last five years before selling it, you can exclude up to $250,000 of profit if you're single and up to $500,000 if you're married filing jointly. This can be a significant relief for homeowners looking to cash in on their property's appreciation without a hefty tax bill.

Another strategy is a 1031 exchange, which allows you to defer paying capital gains taxes by reinvesting the proceeds from your sale into another "like-kind" property. This is particularly useful for real estate investors looking to grow their portfolio without immediate tax consequences.

Investing Strategies to Minimize Capital Gains Tax

Investors have several options to minimize their exposure to capital gains tax. One approach is dollar-cost averaging, where you invest a fixed amount regularly over time. This can help smooth out market volatility and reduce the likelihood of realizing large gains all at once.

Another option is investing in Opportunity Zones. These are economically distressed areas where investments can qualify for special tax breaks. By holding an investment in an Opportunity Zone for at least ten years, you can potentially eliminate capital gains taxes altogether.

Recent Real Estate News Impacting Capital Gains

Staying updated with real estate news is essential for making informed decisions about your investments. Recently, there have been discussions in Congress about increasing capital gains tax rates for high-income earners. While these changes are still under debate, it's crucial to stay informed as they could impact your investment strategy.

Additionally, the housing market has seen unprecedented growth over the past year due to low interest rates and high demand. This surge has led many investors and homeowners to consider selling their properties. However, with potential changes in tax policy on the horizon, it's more important than ever to plan strategically.

In Conclusion

The real estate market has seen a significant surge over the last ten years, with home values skyrocketing to double their previous worth. While this appreciation is great news for homeowners, it comes with a potential sting: a hefty tax bill when you decide to sell. The silver lining? There are strategic moves you can make to soften the blow of capital gains taxes. Understanding capital gains taxes in real estate is vital for both sellers and investors. By leveraging strategies like the primary residence exclusion and 1031 exchanges, you can significantly reduce or even avoid these taxes. Staying informed about recent legislative changes and market trends will also help you make smarter investment decisions. Whether you're selling a home or growing your real estate portfolio, a proactive approach to managing capital gains can save you money and maximize your returns.

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

dgonzalez@homesunlimited.solutions

8803 Futures Drive Unit 10A, Orlando, Florida, 32819, USA